Wheels within Wheels: Members Only #12

I unpaywalled this 2019 post in late 2020, concurrent with some discussion about “stakeholder capitalism.” I made some minor edits and fixed broken links in early 2022.

Thank you for throwing your financial support to On Management — and a warm welcome to new supporting members!

This time, corporations are now less-evil People.

Happy end-of-summer. I’m celebrating by wearing my white jeans one last time and eating grape Jolly Ranchers.

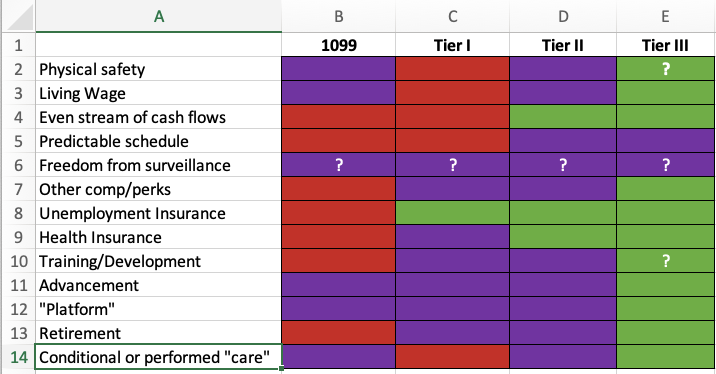

Table stakes

A group of American CEOs known as The Business Roundtable had decided that Shareholder Primacy is dead. Or dead-ish.

Shareholder Primacy, or Shareholder Value Maximization, is an idea (cult, creed, or accepted wisdom) that corporate boards have a “fiduciary duty” to maximize the value of a shareholder’s investment.

I’ve opined – at some length, in a conversation with journalist and accountant Francine McKenna, in The Power of Myth (in Business): On Management #33 – that media outlets have failed to adequately interrogate Shareholder Primacy.

Through repetition, belief in Shareholder Primacy has developed a weight of truth — and even the law.

The labor markets we’re all navigating are one result of corporate behavior based on shareholder primacy. I’d also draw a direct line to the devastating effects of the financial crisis.

(And probably the next financial crisis, too.)

Today, the CEO members of The Business Roundtable have a new story: corporations should consider the interests of other stakeholders. Employees, communities, the environment, countries, customers.

Who will interrogate their newly-enlightened position?

When companies have issues, I frequently hear, “People are saying,” when people want to talk about problem that they don’t want to own: it’s a disclaimer.

So, hard eyeroll at one media MOOD: “People are saying that these promises may not have teeth.” That’s not pushback.

Also, I did not read, see, or hear a single news piece revisiting a key point of the shareholder primacy argument. How about “Hey, guys, what happened to this fiduciary responsibility that you’ve been bandying about as though it were law?”

I’m not asking for any apologies or retractions, lol.

Where’s the history?

My hypothesis: in business reporting, the role of access journalism is primary.

CEOs you want to profile often need you to give their story a bit of love, cough cough Fortune.

A singular PBS NewsHour piece with Steven Pearlstein shows this point, without telling.

Pearlstein is a Washington Post columnist, professor, and author who has used his platform to criticize shareholder primacy.

And yet…

John Yang: A year ago, you wrote in your column that the decision to declare maximizing value for shareholders as the sole purpose of a corporation is the source of much of what has gone wrong with American capitalism….

Now, after you wrote that column, Jamie Dimon, the chairman of J.P. Morgan Chase, reached out to you. What happened?

Steven Pearlstein: We know each other. And I was having breakfast.

And I picked up the phone and somebody said: "That was the stupidest column I ever read."

And I said: "Good morning, Jamie. How are you?"

And we had a frank discussion. At the end of it, I said: "Look, why don't you have a dinner somewhere? You can come in here. I will host one here. Or we will do it in New York, and you have some of your guys and I will have some of the other journalists there."

Oh. Dinner. With some of your guys. And my guys.

Pearlstein: …he (Dimon) thought we journalists were misportraying this issue, that he said: "We don't run our companies in the ruthless, profit-maximizing way that you suggest."

And I said: "Well, first of all, I'm not sure that's always the case, but even if it were, then why don't you just say that is not the — that that shouldn't be the norm??

And he didn't really have an answer for that. And that's sort of what — what — eventually, we did have this meeting in New York in his office, and we hashed things around.

And I think, you know, we acknowledge that, no, they don't all run their companies in a ruthless way 100 percent of the time. And he acknowledged that maybe they needed to think about reframing the purpose of a corporation.

CEOs are saying they need to be more socially minded. Will anything change? PBS NewsHour, August 20, 2019

Pearlstein goes on to remark that CEOs need the Business Roundtable, for cover. Solidarity.

“So, one of the reasons something like the roundtable exists is for them to do it collectively, so it's a sort of mutual protection society. They can do what they think is the right thing and not get called out individually for it.”

NB: Business Roundtable is not a union. The term “mutual protection society” is an odd, specific way to characterise the group.

Costco is the evergreen counter-example to Pearlstein’s assertion. And, being a public company is a choice and a privilege. But I digress.

So, as Twitter raged, Thought Leaders flexed: what will these leaders actually DO?

A better question: is it okay for the purpose of a corporation to be subject to the values and actions of a network of powerful mostly-white mostly-men?

And, what agency do we have, as “stakeholders”?

Chivalry is not dead

“How can we develop and advance a better understanding of business history?” was one of my questions for 2019.

Unclear. I’m trying to be better, on my own. So, what about The Business Roundtable?

We didn’t elect them, we don’t know how they operate. Frontmen for their new narrative? Two CEOs with recent PR fails: Jamie Dimon and Alex Gorsky.

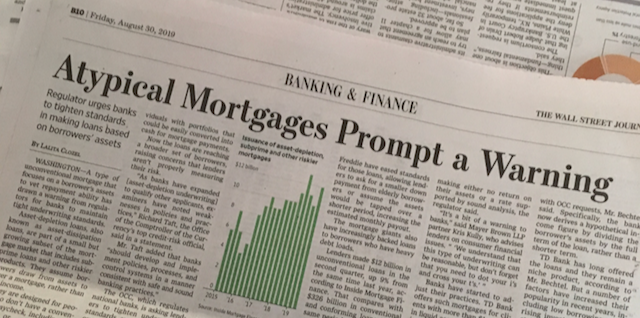

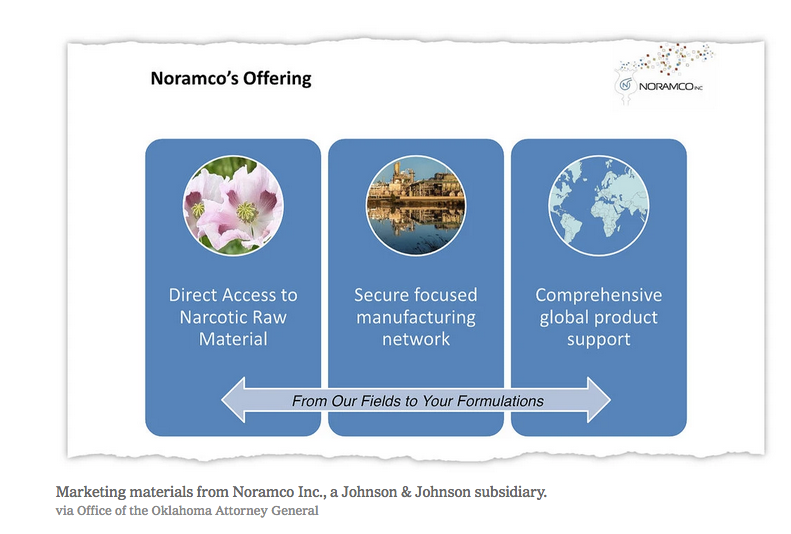

Gorsky helms Johnson & Johnson, a company recently unveiled as a vector in the opioid epidemic.

Straight out of a William Gibson novel, for decades J&J owned a Tasmanian poppy farm, where they developed strains of poppies to “increase production of raw materials.”

What.

J&J ranks #8 in the WSJ/Drucker Institute “Management Top 250.”

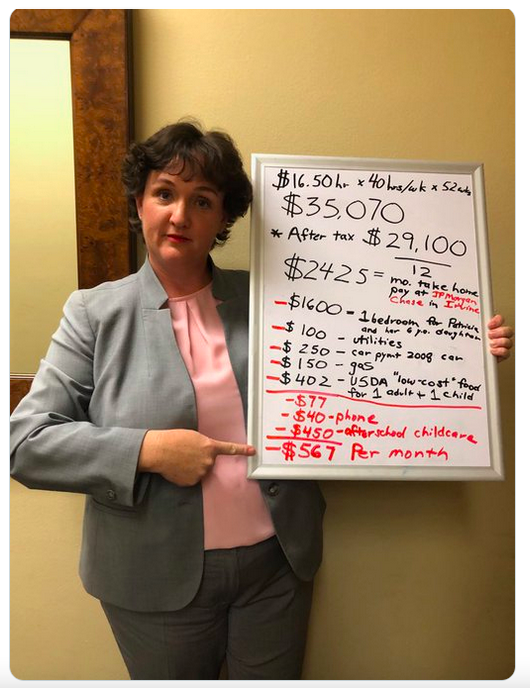

JP Morgan Chase comes in at #27. Yet a few months ago, Chase’s Dimon couldn’t answer California Representative Katie Porter’s questions about how an employee in a Chase branch in her community could afford, basically, life.

During my questioning, @jpmorgan CEO Jamie Dimon said he didn’t know if all my numbers were accurate. Here’s the math so he can check. pic.twitter.com/OIDkrWfASC

— Rep. Katie Porter (@RepKatiePorter) April 10, 2019

So what is the Business Roundtable? I started poking around.

A few books seemed promising:

Why is Corporate America Bashing Our Public Schools? by Kathy Emery and Susan Ohanion (Indiebound) (library) (used, Alibris)

Emery’s PhD dissertation opens by describing BRT lobbying efforts around education. Rather than wade through the PDF, I found her book based on the dissertation. The copy I ordered isn’t here here yet.

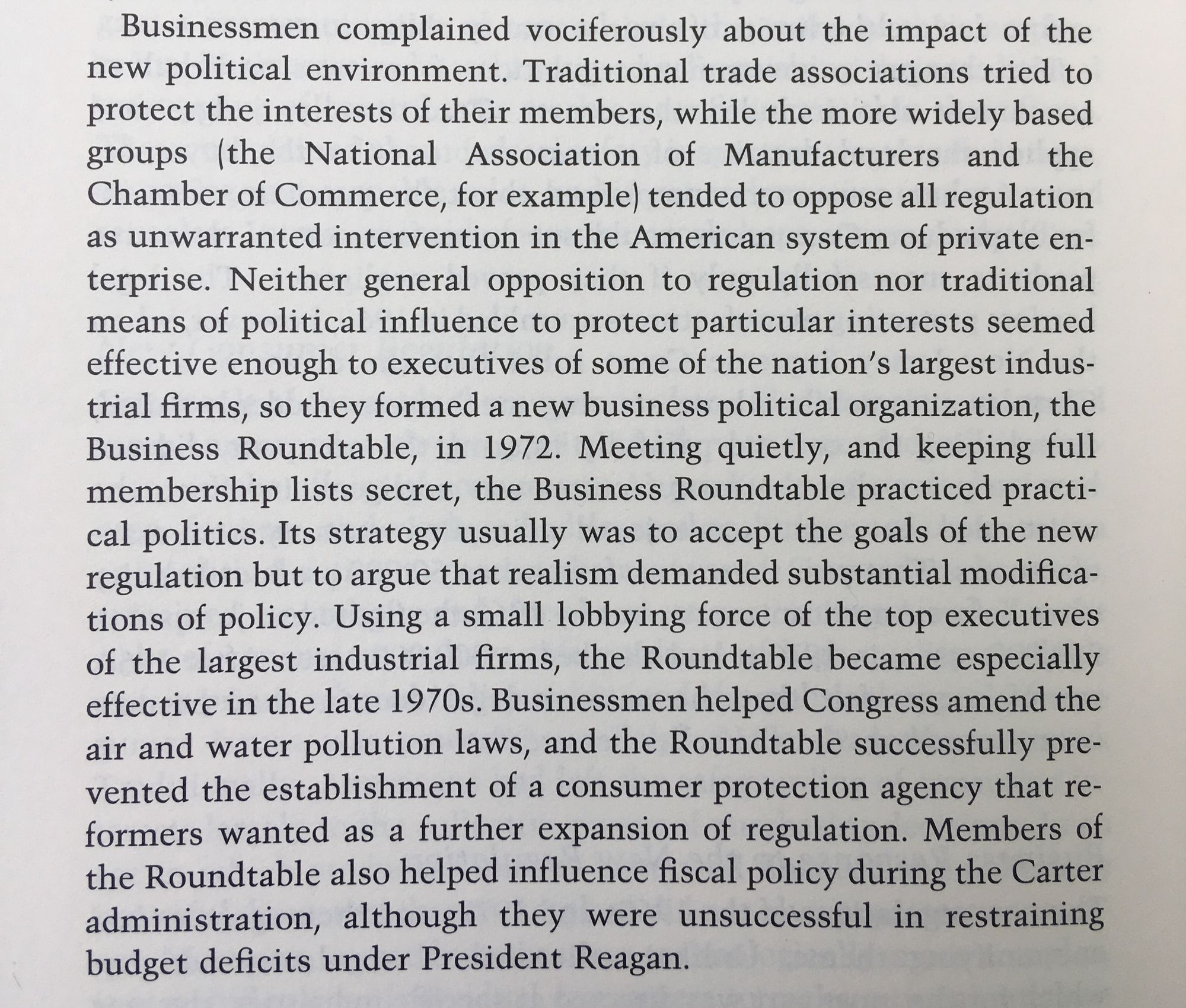

- Business Enterprise in American History, by Mansell G. Blackford. (Indiebound) (library) (used, Alibris)

This textbook may have been quoted in one of the articles I read. It’s out of print; I got a used version, 1986. Sadly, the BRT only appears on page 414.

I also found Sharon Beder’s Suiting Themselves, How Corporations Drive the Global Agenda (Indiebound) (library). It describes global networks of groups like the BRT, overwhelming. It arrived yesterday, thanks to interlibrary loan; on my TBR.

I also called a lifeline.

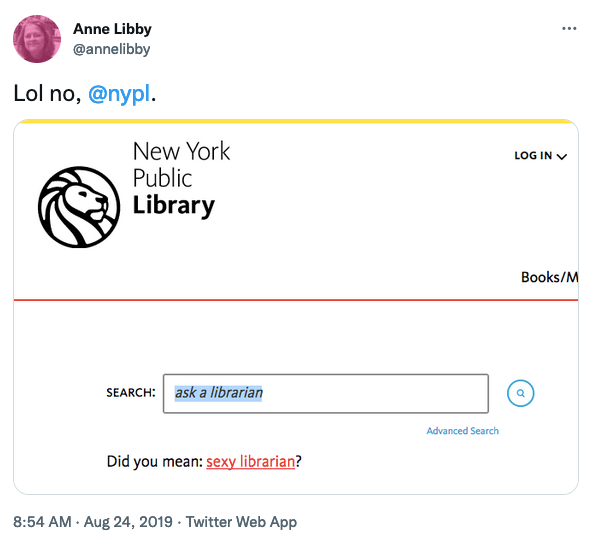

With human librarians answering our emailed questions: how much more could I heart the NYPL?

But, first, oops.

And, bad news, though.

Anne: Can you recommend a book that includes -- or is -- a history of The Business Roundtable? Thank you!

Chaz: There are no books on the Business Roundtable. Your best bet for learning more about them is to read articles. I did a search but all the books on their organization, most of which they published, are old and don't directly deal with them as a company…

Email communication with Chaz, an AskNYPL information specialist

Note that Chaz referred to the BRT as a company. Online, they’re a dot-org. Their website is a bit, um, opaque about their workings.

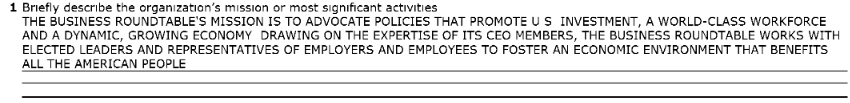

Per the IRS, the BRT is a 501(c)6, which is the tax-exempt designation for business leagues. Also “chambers of commerce, real estate boards, boards of trade, and professional football leagues.”

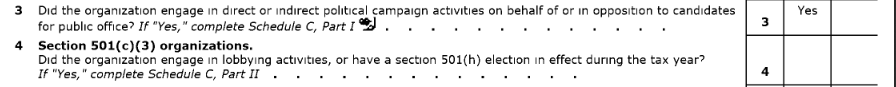

Unlike many 501(c)3 organizations, the BRT doesn’t share their financial information on their website. Thanks, IRS, for posting the BRT’s 2017 form 990.

A couple of notable excerpts.

Hmmm.

The political campaign activities in Line 3 are described as $25K paid to the Republican Governors Association, whoever they are, for membership in the Governor’s Council. Whatever that is.

Reminder: the Business Roundtable is a mutual protection society. I mean, a network.

If meaningful inferences are possible, I don’t have the financial analysis chops — or time — to dig into these numbers.

That said, interesting.

Chaz shared links to a some online library resources for further research (hmu if you’re interested in seeing them.) We went on to agree: someone must write a book about The Business Roundtable.

If there’s a writer out there with knowledge and inclination to dig into this story, once they get started, will they still have access?

And, can they afford to do the work?

Even when bschool professors are tenured (you’d be surprised), many have corporate side gigs.

My fear: access means making sure that you maintain relationships that get you invited to those dinners. With your guys and my guys.

You know, to hash things around.

Easy as 1-2-3

IMO, any history of how shareholder primacy came to be seen (by some) as a norm would have to evaluate the role of technology, and the spreadsheet as we more or less know it today.

As the BRT was ascending, banks and investors were adopting Lotus 123. A few months of training could turn a recent college grad into a financial analyst.

“When Company X cuts 20% of the workforce, what happens to the stock price? 30%?”

I’m guessing that it once took weeks to build financial models and “what-if” analyses. Lotus, and then Excel, could make this into an afternoon’s work.

After falling into wormholes on the internet, I decided to leave this for another day. Or for someone else.

Coaching Hall of WT, um H

So part of my continuing rumination on coaching has been inspired by the increase in people approaching me to inquire about my services.

This puts me into a position to hear a range of expectations they were expressing. The last few people I talked with told me that they were looking for someone to be “tough” on them.

I was mystified by this confluence.

Until a few weeks ago, when I spoke with a man who helped me to see where this was coming from. Maybe Trillion Dollar Coach has catalyzed the idea of the coach as The Larger than Life individual who will tell you that you’re being a jerk.

So, courtesy of the library, I came up on the Trillion Dollar Coach waitlist, and I hope to verify my hypothesis. Or not.

And nobody at work is larger than your life.

And, not everyone who uses the title “coach” is operating from the same playbook.

- The World’s Strangest Executive Coach, according to Forbes early in this century, was recently convicted of swindling people out of money via a sex cult.

- A friend asked me what I thought about hiring a coach trained/certified by someone accused of misconduct. I thought, “No. No way, no how.”

- I would swear on a stack of sacred tomes that I had seen a founder listed on the coaching roster at a life/corporate coaching firm – the founder had been dragged in the media for having created a uniquely dysfunctional office environment. This founder recently launched a new venture, I went back to check the coaching firm’s website: they were no longer appeared to be coaching.

Here’s one thing, though — in certain circles, being a Coach or Consultant is stronger branding than being Unemployed.

TBR/Still Reading

Also, by the end of the holiday weekend I hope to have finished the last of Denise Mina’s police procedurals featuring Alex Morrow. The stories are complex, Alex is sometimes a jerk, and the resolutions are often full of the loose ends that happen in real life.

I’ve written before about detective novels being about workplaces and workplace relationships. It’s great to have found Mina and Jane Harper this summer.

The 1619 Project

Until recently, U.S. economic/business history, as written and taught, has failed to reckon with the effects of slavery, or even slavery’s existence.

It’s exciting to see this beginning to change. When I see gaps in my own understanding, it’s both disheartening and energizing.

The NY Times 1619 Project has been difficult for me to read and digest in newspaper form (teeny font, many sections, difficult material.) I felt like reading online would put this work in competition with all of my other tabs.

I long to focus, and for focus. With hope, I await a book.

Until then, the 1619 Podcast is made for how I’ve been working to use my attention. If you’re not a podcast listener, you can read the transcripts.

Brava to Nikole Hannah Jones, and to every other creator on the team.

Links

Whoa, this got long.

In Our Time, Chivalry. Melvin Bragg on BBC Radio 4. Networks and mutual protection societies are much older than the Business Roundtable.

Jeffrey Epstein and the Power of Networks by Adam Rogers at Wired. If it weren’t for the academic connection, I’d have kept this as an Epstein-free zone.

And yet, like the BRT, here’s an example of an extra-institutional network of mostly-white men making decisions that have wide impact.Panera is losing nearly 100% of its workers every year as fast-food turnover crisis worsens by CNBC’s Eric Rosenbaum. Ouch.

Speaking of spreadsheets, is the source of Amazon’s recent announcement that it will spend $700 million training workers:Analysis of employee churn, and what robots can’t do?

An altruistic desire to enable employees to self-actualize on their dime?

I’ll come back to this.

- Biblio is my favorite non-Amazon source for used books.

Welcome to almost-fall. And thank you so, so, much for supporting On Management.

If there’s something you want to see here, please send me a note with your questions or suggestions!

Thanks,

P.S. I’d be honored if you were to occasionally share member’s editions like this one with colleague or friend!

Subscribe to the free newsletter

Here’s a link to Johnson & Johnson’s vaunted Credo. A bschool classmate was a J&J executive; she really believed in the Credo as a basis for ethical corporate behavior.

WTH J&J, poppies?