The Power of Myth (in Business): On Management #33

A myth is also a meme

So I made a dorky meme to go with this month’s audio.

There’s a story out there: companies must squeeze every last dime out of an organization to maximize their share price, for the benefit of the shareholders. Because the law.

This story is called shareholder value maximization, or shareholder primacy.

The thing is, there is no law. It’s not true.

Yet this myth has reached into organizations of all kinds. Including non-profits, b-corps, and privately held companies.

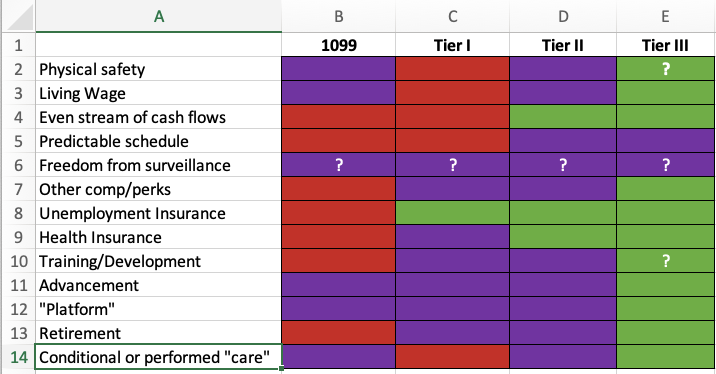

One example, in organizations that hire contractors to work alongside employees.

I’ve seen this firsthand, for example, in conversation with a security guard at a church I attend. About the church, where he was a contractor. It was also true of doctors in an emergency room I visited (bizarrely resulting in out-of-network care, but I digress.)

Two not-for-profit organizations. They don’t even have shareholders.

Yet a church and a hospital both made management decisions that pass off benefits and payroll taxes to someone else: maybe a staffing firm; maybe the contractors themselves.

What’s the origin of shareholder primacy? Why do we accept it?

And, why do some business journalists write about — and thus amplify — shareholder primacy as though it’s the truth, rather than an “active and contentious debate”?

In this month’s audio, journalist Francine McKenna talks with me about shareholder primacy and some of its effects.

Francine launched her blog, re: The Auditors, in 2006, initiating her career shift from accounting to journalism. Today she’s the Transparency Reporter at Dow Jones’ Marketwatch.com, where her experience and subject matter expertise inform her journalism.

Click here to listen. (If you’d like a transcript, scroll down for info.)

(Sadly, photo links aren’t working on Substack right now: you’ll have to click one of my text links to listen, or find me over on Soundcloud.)

If you’d like to learn more about shareholder primacy, Francine shared some articles:

- There Is No Effective Fiduciary Duty to Maximize Profits: Corporate law in five minutes by James Kwak.

- How Milton Friedman Fomented the Barmy “Corporations Exist to Maximize Shareholder Value” Myth by Yves Smith.

- Francine’s articles: Journalists’ Obligations In The Shareholder Value Maximization Debate and New York Times Reporters Perpetuate Popular Corporate Governance Myths.

“What do we call…anyone who only focuses on making as much money for themselves in the immediate future — even if this involves harming others or breaking the rules? We call that person a psychopath.”

Lynn Stout

Lynn Stout’s epic takedown of shareholder value maximization is, simply, COMPLETE.

Don’t simply believe what you read about people management, either

Until the internet, most of what you read about managing people at work was at least average.

How I Read About Management

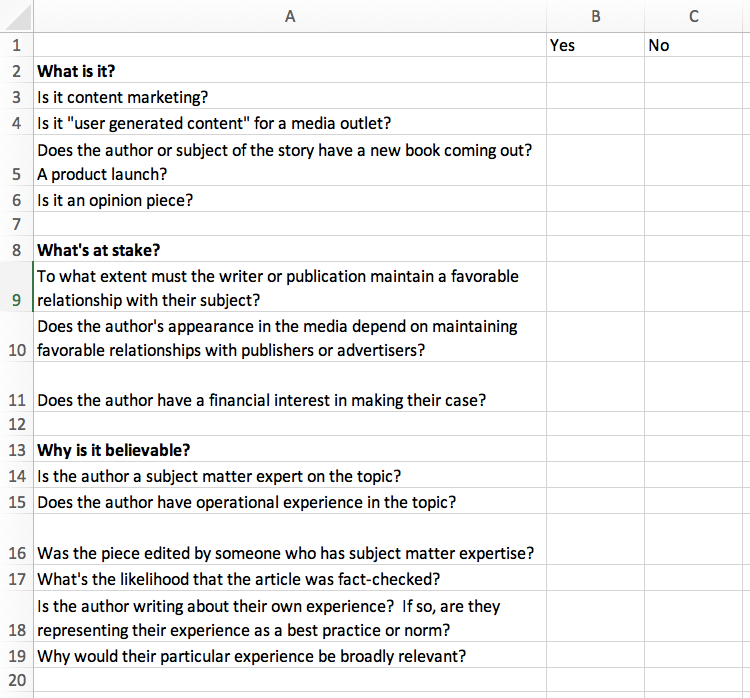

I asked Francine about how we can be better consumers of business media.

She suggested that we do our due diligence.

Back in the 00s, I took a brief business journalism class with Rick Levinson. I was shocked to learn that articles aren’t always fact checked. And that some business journalists haven’t studied business.

These days, I’d bet money that few business writers have managed a team.

Today, I think it’s safe to call holacracy “discredited.” 4-5 years ago people I knew in real life were trying to convince me that it would be awesome: they had read glowing stories about Zappos and Medium.

So if what we read about management in the business press can’t be taken at face value, surely practitioners won’t steer us wrong. Right?

I’m going to say “No” to the first-time-founder-first-time-manager who writes about how they’re innovating around management.

Context is key. What works for you in one organization may fall flat in another. Or in the same organization, with a different team. Or under different economic circumstances.

(How did I learn this? By falling, multiple times, in multiple domains.)

I’ve written about how I read about management. Here in On Management, I’ve analyzed articles and books based on my view of whether they’re true, credible, and useful in practice.

But my due diligence really goes deeper.

Here’s my draft list — a work in progress — of elements I consider when deciding whether something is worth reading, citing, or recommending.

(And I may unpack this in more detail down the road — either here, or elsewhere.)

What do you think?

A question

How do you decide whether to believe what you read, see, or listen to?

Let’s talk about missionwashing

Greenwashing is acting to appear environmentally friendly, when you’re not. Mathwashing uses math to make subjective realities appear to be objective.

My working definition of missionwashing: when an organization uses “purpose” — or mission — as an excuse to cut corners.

There are companies that break the law because they’re “disrupting.”

Others exhort people to work around the clock because they’re “changing the world.”

There are way easier places to work, but nobody ever changed the world on 40 hours a week

— Elon Musk (@elonmusk) November 26, 2018

NB: the nature of human existence is to change the world.

Overworking and working in hostile conditions are optional. When you’re fortunate.

When we manage people, our day-to-day decisions matter.

No organizational mission — or shareholder’s pocketbook — should put people in a position to miscarry at work. Or to die there.

Let’s talk about “innovating” around management

Hopeful people who wish for a more equitable world, I am one of you!

That said, IMO it’s not going to come from some disruptive innovation in management. Like holacracy.

Some hypotheses about organizations that seem to do well with alternative management structures:

They’re small, and often privately held. Their workforce is a single-digit multiple of Dunbar’s number.

They have a bankroll. Whether the organization owns a market, or has an owner who backs the experiment, financial performance enables a lot of experimentation.

- They have a strong leader. Often the founder or a family member.

They’re rare.

Innovation won’t save most of us. We have to be better managers.

Fight me.

Links

- I can be critical of The New York Times for some of their how-to articles about work. (For heaven’s sake, a disclaimer to one of their workplace advice columns is that the author is “not a professional career advisor.” Also: advice columns are garbage.)

Here’s how the NYT brilliantly covers the workplace: The Human Toll of Instant Delivery, at their podcast, “The Daily,” based on reporting by Jessica Silver-Greenberg and Natalie Kitroeff. Bravo. - Alberto Brandolini’s BS* Asymmetry Principle: “The amount of energy necessary to refute bs* is an order of magnitude bigger than to produce it.”

Calling BS*: Data Reasoning in a Digital World is a fantastic course website by University of Washington professors Carl Bergstrom and Jevin White. I have not come close to consuming everything they’ve posted: so far, so good. Their YouTube playlist breaks lectures into quick videos; the quote above is from Episode 1.3.

*(Yes, I prudishly abbreviated a word I wouldn’t say at the dinner table with my family. Yes, I do occasionally say this word IRL.) - Francine McKenna has also been watching Theranos: The last days of Theranos — the financials were as overhyped as the blood tests.

ICYMI, Issue #29 contains my brief review of Bad Blood. - How to lean against your biases: A conversation with Daniel Kahneman is a great interview by Millie Tran. Written for/about journalists, it’s useful for all of us.

- Last time I recommended The Washington Post’s newsletter, “On Leadership.” Then I got a note that it would be discontinued! That said, journalist Jena McGregor does a solid job of covering management.

Thanks to Francine McKenna, you can find her on Twitter, @retheauditors.

Thank you for reading. And many, many thanks to those of you who have shared On Management with a friend or colleague — and to my supporting members.

I love to receive your questions and suggestions, and respond to all incoming wisdom!

Until next time,

- Last time: The Superpower of 1:1 Meetings, On Management #32

- Members: History Is For Us To Make, Every Day: Members Only #6

P.S. Transcript for this month’s audio

For the first (and maybe only) time, I’m experimenting with offering a transcript for my audio.

- Supporting Members will receive a free transcript under separate cover.

- If you are Deaf or hard of hearing, please contact me and I’ll send you a copy.

Be skeptical. Even when you’ve read it here.